Page 27 - FNTA Buyers Guide_2020

P. 27

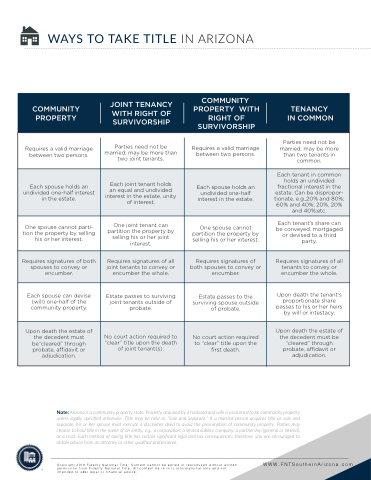

WAYS TO TAKE TITLE IN ARIZONA

JOINT TENANCY COMMUNITY WITH RIGHT OF PROPERTY SURVIVORSHIP

COMMUNITY

PROPERTY WITH TENANCY

RIGHT OF IN COMMON SURVIVORSHIP

Parties need not be Requires a valid marriage married; may be more than

between two persons. two joint tenants.

Requires a valid marriage between two persons.

Parties need not be married; may be more than two tenants in common.

Each spouse holds an undivided one-half interest in the estate.

Each joint tenant holds

an equal and undivided interest in the estate, unity of interest.

Each spouse holds an undivided one-half interest in the estate.

Each tenant in common holds an undivided fractional interest in the estate. Can be dispropor- tionate, e.g.,20% and 80%; 60% and 40%; 20%, 20% and 40%;etc.

One spouse cannot parti- tion the property by selling his or her interest.

One joint tenant can partition the property by selling his or her joint interest.

One spouse cannot partition the property by selling his or her interest.

Each tenant’s share can be conveyed, mortgaged or devised to a third party.

Requires signatures of both spouses to convey or encumber.

Requires signatures of all joint tenants to convey or encumber the whole.

Requires signatures of both spouses to convey or encumber.

Requires signatures of all tenants to convey or encumber the whole.

Each spouse can devise (will) one-half of the community property.

Estate passes to surviving joint tenants outside of probate.

Estate passes to the surviving spouse outside of probate.

Upon death the tenant’s proportionate share passes to his or her heirs by will or intestacy.

Upon death the estate of the decedent must be“cleared” through probate, affidavit or adjudication.

No court action required to “clear” title upon the death of joint tenant(s).

No court action required to “clear” title upon the first death.

Upon death the estate of the decedent must be “cleared” through probate, affidavit or adjudication.

Note: Arizona is a community property state. Property acquired by a husband and wife is presumed to be community property unless legally specified otherwise. Title may be held as “Sole and Separate.” If a married person acquires title as sole and separate, his or her spouse must execute a disclaimer deed to avoid the presumption of community property. Parties may choose to hold title in the name of an entity, e.g., a corporation; a limited liability company; a partnership (general or limited), or a trust. Each method of taking title has certain significant legal and tax consequences; therefore, you are encouraged to obtain advice from an attorney or other qualified professional.

Copyright 2018 Fidelity National Title: Content cannot be edited or reproduced without written WWW.FNTSouthernArizona.com permission from Fidelity National Title. All content he re in is informational only and not

intended to offer legal or financial advice.